IS YOUR ORGANIZATION READY FOR THE COMING BUILDING REVOLUTION?

The American building community of developers, architects, engineers, contractors and building construction firms are currently facing a multitude of challenges that require urgent attention. The scale and scope of these challenges will force change at a revolutionary rather than an evolutionary pace. Marginal improvements and refinements aren’t going to cut it any longer, since many of the current challenges facing the sector will almost certainly continue to get worse rather than improve. Moreover, although this article mainly focuses on the domestic front, these challenges are by no means confined to the United States. In fact, many of them are more pressing abroad, in both advanced and emerging economies.

Are you ready for the revolution?

THE PROBLEM

The demand for housing will only get stronger over the next decade.

The US housing stock is underbuilt. From 1959 to 2000, the US averaged 1.51M housing starts per year as the US population expanded from 177M to 282M over that time. Since then we have experienced a major housing boom from 2001 to 2005 (when housing starts averaged 1.83M), followed by a cataclysmic housing slump that saw average annual housing starts of only 954K over the 2007-18 period, even as the US population grew to 327M. The US housing stock is underbuilt by at least 2M units, and possibly as many as 4M units.

The US housing stock is old. As of 2017, the median owner-occupied single-family home was 40 years old, compared to 27 years old back in 1993. More than half of US homes were built before 1980. The pace of building has been so anemic that as of 2017, there were more than 20% more housing units standing that were built between 1980 and 1985 (a period that contained two recessions) than were built between 2010 and 2017 (a period that contained zero recessions).

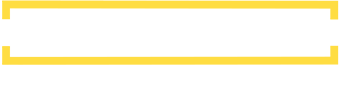

A demographic tailwind is coming soon. The need to build more homes is only going to become more acute over the course of the 2020s as the bulge of Millennials transitions into their prime home-buying years. As of the middle of 2019, the two largest age cohorts were 28 and 29 years old (Graph 1). This group will be in their early- to mid-30s as we enter the middle of the next decade.

US homebuilders will be hard-pressed to meet this burgeoning demand.

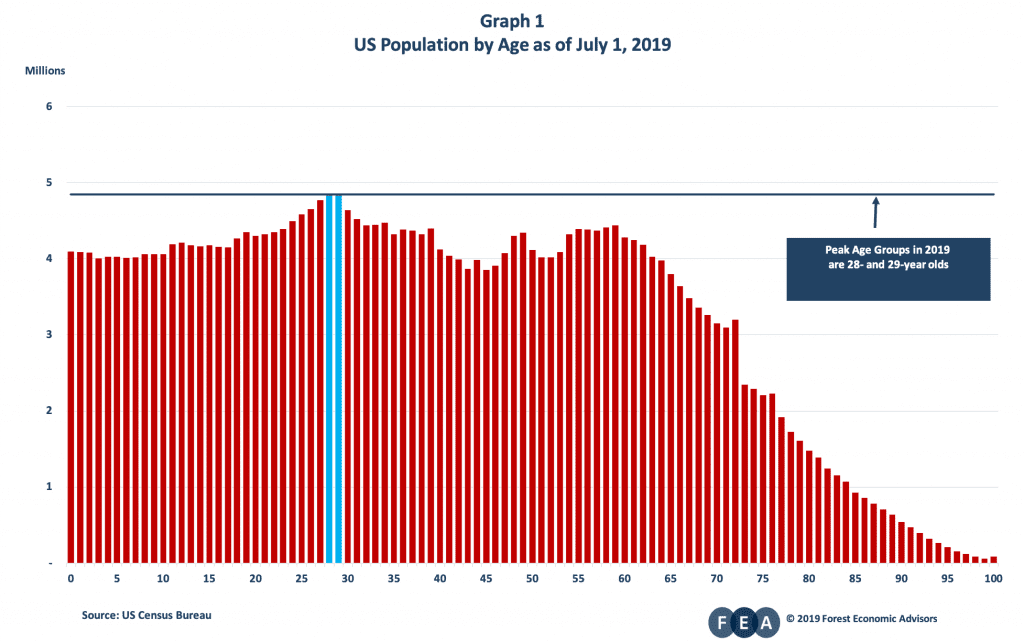

Labor is scarce in the residential construction sector. Employment in the residential construction sector is 16% lower than its pre-recession peak, and yet the unemployment rate for the sector is at an all-time low. Surveys of homebuilders and general contractors reveal large and growing shortages of virtually every trade associated with residential construction. Meanwhile, job openings in the construction sector are about 30% higher than their pre-recession peak (Graph 2). Construction labor is aging rapidly, and the industry continues to struggle to attract young workers.

Don’t expect immigrants to fill the void. Immigration from Mexico had already dried up prior to 2016 due to demographic trends in Mexico (the birth rate fell sharply in the 1990s) and the improving economy there. The current Administration’s policy stance will further ensure that foreign-born workers will not alleviate labor shortages in the sector.

Productivity in the construction sector is abysmal. We are still using construction methods that were employed decades ago. A widely cited study by McKinsey & Company showed that between 1995 and 2015 construction output per worker per hour declined by about 20%; this measure increased by about 40% for the US industrial sector over the same period. The NAHB disputes this finding, asserting that construction productivity was flat over that time period. Even if this is true, it’s still nothing to brag about.

The rent (and the mortgage) is too damn high! Builders are finding it increasingly difficult to build housing that middle-class people can afford. The median household income in the US is about $65K per year while the median price of a new home is over $325K. That math simply doesn’t add up even with rock-bottom interest rates. The problem is especially acute on the West Cost and the Northeast. A report by the Government Accountability Office covering the period 2011-15 showed that the median per unit cost of delivering a single unit in a multifamily housing development was $326K in the state of California and $284K in New York City. These are not luxury units by any stretch, as the report covered only housing units that were eligible for government subsidies.

Current construction methods and materials produce a lot of waste and they exacerbate climate change. Go to a typical single-family construction site and you will see a huge dumpster that will often need to be emptied several times over. Meanwhile, urban construction is still dominated by concrete and steel which are not renewable, not energy efficient, and do not sequester carbon.

THE SOLUTION: OFFSITE CONSTRUCTION USING WOOD AS THE PRIMARY BUILDING MATERIAL

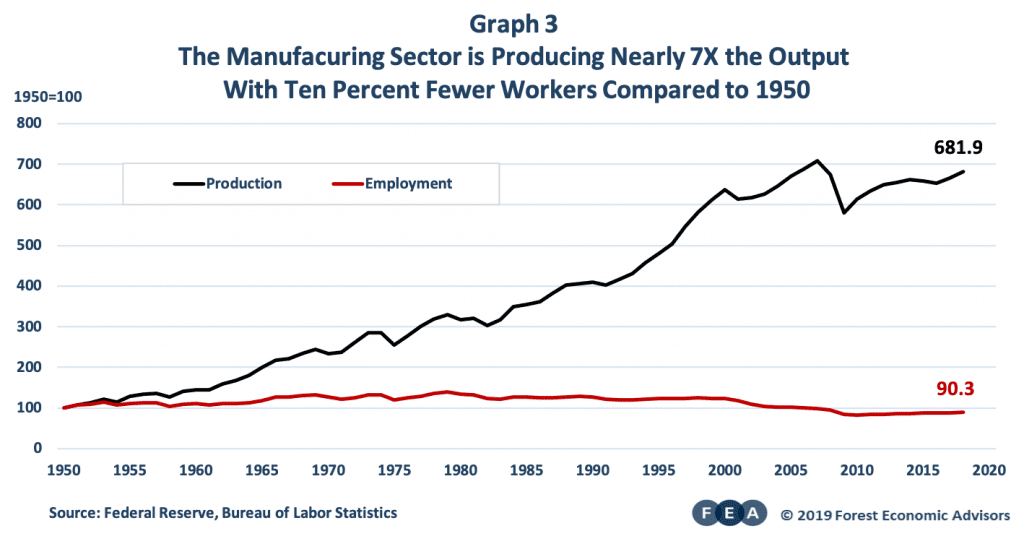

Gerard McCaughey, the CEO of the offsite building firm Entekra, sums up many of the challenges discussed above thusly: “If you have a labor-constrained process and you can’t change the labor, then you have to change the process.” The manufacturing sector has certainly learned how to make do with fewer workers. Manufacturing output has increased by 700% since 1950, even as manufacturing employment has declined by 10% (Graph 3). It is time for the construction industry to borrow methods from the highly productive manufacturing sector. The first step in this process is to move most of the process into a factory setting and turn the building site into an assembly site.

The benefits:

- Building Information Modeling (BIM): Allows for digital prototyping and advanced coordination of designs, minimizing mistakes and delays in the field

- Speed: Construction of elements and/or modules is simultaneous with construction of foundations

- Less labor, less training: More of the work is automated, requiring fewer specialized skills

- Expand the potential workforce: The factory environment will open up construction jobs for women

- Weather: Construction is indoors, where the weather is always sunny! Delivery is just-in-time and assembly is fast

- Greater efficiency, quality, and predictability: Greater precision exists in the manufacturing process, resulting in higher quality (fewer callbacks and warranty issues) – and far less waste!

- Greater procurement efficiency: Material requirements are more accurately calculated, including buying in bulk – and buying direct from manufacturers

- Safety: Falls from height and equipment accidents do not present as much of an issue offsite

The future of wood-based construction is not going to be dominated by any one product. Mass timber (such as cross-laminated timber which is widely known as CLT), modular and panelized light-frame construction are all going to play a role. Stakeholders in the sector would be well-advised to focus on the process, not the product.

WHY WOOD?

Wood has a number of key advantages over steel and concrete, its main rivals as a building material. Consider the following:

- Wood is renewable. According to Thinkwood, the current volume of tree growth in North America is nearly 40% higher than the annual harvest.

- Wood is a zero-waste industry. Moreover, when we convert the construction site to an assembly site, the amount of waste shrinks to as little as 10% of a traditional stick-built home.

- Wood is green. A Thinkwood analysis that looked at equivalent 40K square foot buildings showed that concrete and steel produced 470% and 300% more water pollution respectively than did wood. The concrete and steel building consumed 190% and 140% more fossil fuels than the wood building.

- Wood stores carbon. Steel and especially concrete are huge emitters of carbon dioxide. In contrast, wood sequesters carbon. The seven-story, 220K square foot T3 building in Minneapolis – which uses CLT as its primary building material – will take the equivalent of 996 cars off the road for a year due to its wood construction. Meanwhile, it took just 15 minutes for North American forests to grow the amount of wood used in T3.

IWBC 2019

If you are interested in what the future holds for construction, the Industrialized Wood-Based Construction Conference in Boston is the place to be from November 4-6 this year.

- See and hear from 43 of the brightest minds and most innovative companies in the world on topics ranging from offsite financing to mass timber, to modular, to panelized, to BIM software, to carbon impacts and fire safety;

- Get up to speed on the latest advances in robotics and artificial intelligence in the building industry;

- Peruse our 42 exhibits to see cutting edge technologies, building materials, software, and machinery; and

- Network with leading players in offsite wood-based construction.

The last word comes from McKinsey’s recently published report, Modular Construction: From Projects to Products:

After decades of relatively slow change, an at-scale shift to modularization—alongside digitization— looks likely to disrupt the construction industry and broader ecosystem. All players should evaluate the trend and impact, and assess their strategic choices, to ensure they can benefit rather than risking being left behind.1

We would only add that all players should attend IWBC rather than risking being left behind!

Authors:

Brendan Lowney, Principal, IWBC and Forest Economic Advisors

Art Schmon, Managing Director IWBC and Partner, Forest Economic Advisors

[1] Bertram N, Fuchs S, Mischke J, et al. Modular Construction: From Projects to Products. 2019. McKinsey & Company.